Blended Learning, Domestic, For-Profit, International, K-12, Mergers & Acquisitions, Required, Startups, Technology, Universities & Colleges - Written by Wired Academic on Thursday, March 29, 2012 8:23 - 0 Comments

Blackboard Inc. Buys Moodlerooms & NetSpot In Play For Open Source Profits

Blackboard Inc. said this week that it is acquiring Moodlerooms and NetSpot in a push to be involved in and make money from the open source side of online learning solutions.

It’s a bit of a strange deal as Moodle, with 57 million users, is a free, open-source rival to the Washington, D.C.-based Blackboard Inc., a giant among the course management (CMS), also known as learning management systems (LMS) business. Moodlerooms and NetSpot are official Moodle partners. Blackboard said both companies will operate independently and support their own clients. It doesn’t plan to change leadership of the firms.

The strategy could help Blackboard maintain a strong position in the fast-shifting world of CMS / LMS, which is a big business. Every higher education institution uses a learning management system in some form. They are often expensive licenses, which drive up the cost of education. According to a 2009 report by Tagoras, the average cost for an LMS over three years ranges from $59,000/500 users to $435,000/unlimited usage. Research firm IDC estimates the e-learning infrastructure solutions market grew to roughly $1.6 billion in 2011 from $422 million in 2001. Based on IDC’s forecasts, BMO Capital Markets predicts growth will slow slightly. But it still predicts it will be a $2 billion market by 2016.

Meanwhile, several competitors have emerged for Blackboard both on the for-profit and open-source side, including Pearson LLC. Several mergers have happened in the space. In October 2010, Taleo (TLEO) acquired Learn.com. In January of last year, SumTotal Systems acquired GeoLearning. In May of 2011, SuccessFactors (SFSF) acquired Plateau.

Baltimore-based Moodlerooms is one of the commercial firms that offers customized versions of Moodle as well as hosting services, focusing on clients in North America. It charges schools fees to adapt Moodle’s grade books, student data warehouses and other tools to the individual school needs. It hosts Moodle systems for schools for an annual fee of $1 per user according to an Education Week story in 2008. Meanwhile, Netspot is an Australia-based Moodle partner with similar functions to Moodlerooms but is focused on the Asia Pacific region.

With this deal, Blackboard is creating a new Education Open Source Services group, which says it aims to support the use and growth of open source learning technologies globally. Some open source education advocates, however, were not convinced by the move and are skeptical about Blackboard, which is owned by private equity firm Providence Equity Partners (thanks to a $1.64-billion buyout last year). Moodle fans worry that Blackboard wants to corporatize and co-opt the open source learning movement by buying money-making partners of Moodle. InsideHigherEducation reports:

At Moodle.org’s official “Lounge” forum, some open-source advocates lamented what they read as a corporate intrusion on the open-source community — prompting Martin Dougiamas, the founder and lead developer of Moodle, to defend his decision to lend moral support to Blackboard’s takeovers of Moodlerooms and NetSpot.

“Moodle itself has not, and will not, be purchased by anyone,” Dougiamas wrote to a discussion thread. “I am committed to keeping it independent with exactly the same model it has now.” While the new Blackboard subsidiaries and their clients have produced many helpful modifications to Moodle’s code, “it’s always up to me to include [modifications] in core (after it gets heavily reviewed by our team),” Dougiamas said, “otherwise it goes into Moodle Plugins.” He added that Moodle still has dozens of other partner companies that are not owned by Blackboard.

Charles Severance, another big name in the open-source movement who not only endorsed the deal but has been hired to work with Blackboard’s new open-source services division, expanded on the implications of the move in a post on his own blog. “The notion that we will somehow find the ‘one true LMS’ that will solve all problems is simply crazy talk and has been for quite some time,” Severance wrote. “I am happy to be now working with a group of people at Blackboard that embrace the idea of multiple LMS systems aimed at different market segments.” The watchword of this era of multiple learning platforms per campus, he said, is interoperability, and that will be a priority for him in his new capacity with Blackboard.

Blackboard said leaders from all three companies in the deal met with Mr. Dougiamas in Perth, Australia, to present the plans and win his favor. The meeting included Blackboard CEO Michael Chasen and Chief Technology Officer Ray Henderson, Moodlerooms CEO Lou Pugliese and Chief Architect Tom Murdock, and NetSpot Managing Director Allan Christie. The leaders signed a Statement of Principles to outline how they will work together on code contributions and financial support to the Moodle Trust. Chasen and Henderson published an open letter here to outline their strategy for this deal.

“The decision of Moodlerooms and NetSpot to work under Blackboard may sound very strange at first to anyone in this industry,” said Dougiamas, in a statement, “but it’s my understanding that these three companies have some good plans and synergies. I’m happy to say that Moodlerooms and NetSpot will remain Moodle Partners, and have promised to continue providing Moodle services, participating in the community, and contributing financially to Moodle exactly as they always have.”

The partnership could be an effort by Moodle and Blackboard to fend off other competitors in the open source world such as Instructure (as reported by Chris Dawson at ZDNet).

Dawson writes on the recent deal:

Far less surprising than Blackboards announcement that it had just acquired two of the largest providers of the open source Moodle LMS was the reaction from competitors. Josh Coates, CEO of Instructure (maker of the Canvas LMS; many outside of the ed tech space may remember him as the founder of Mozy) characteristically didn’t pull any punches, telling me Monday night that,

It looks like Blackboard is giving up on innovation and instead is focused on commoditizing the LMS. Moodle, Sakai, Angel, BB 9.1 - it’s all the same to them now. They want to make their money by offering generic IT service and software. Given Blackboard’s decline in LMS market share, i suppose it’s the only option they had.

…

All signs point to Moodlerooms and Netspot being allowed to continue operating in a largely independent fashion and to continue offering Moodle-based services, unlike when Blackboard acquired Wimba and Elluminate to add real-time collaboration and teaching tools to what became their Collaborate product. Their relationship with Angel customers (Angel was another LMS acquired by Blackboard) has been rocky at best, although as part of Monday’s announcements, Blackboard committed to better supporting the Angel LMS.

What appears to be happening here is instead a horizontal play for market segmentation as well as new outlets for Collaborate and Edline (also, like Blackboard, recently acquired by Providence Equity Partners) which I expect will be more tightly integrated with the customized Moodle offerings from Moodlerooms and Netspot. To some extent, Josh Coates may be right: Blackboard has been losing market share and allowing Blackboard to dominate the high-margin, upper end of the LMS market while offering open source solutions for lower-margin market segments is an effective business strategy to recapture users. If Lexus, Toyota, and Scion can all be money makers for Toyota Motors, it makes sense that Blackboard Learn and Moodle can both be money makers for Blackboard.

Blackboard’s deep pockets also ensure that financial contributions to the overall Moodle effort can remain strong, assuming that Blackboard doesn’t decide to head in a different direction than the one it outlined on Monday. The more money that flows into Moodle, the better, given that, although growing in market share, is getting fairly long in the tooth and will have an uphill battle to compete effectively against the like of Instructure, Pearson, and Desire2Learn. What initially looks like it could have been a real blow to the competitive landscape may, in fact, enhance it, although this remains to be seen. However, all skepticism aside, there does appear to be a real shift in mindset at Blackboard after their acquisition last year.

-0-

Here Are Typical Features of a CMS System

The Teacher Education Center at Illinois State University notes that most online course-management systems include:

• Announcements

• Calendar

• Gradebook

• Asynchronous discussion boards

• Synchronous chat room

• E-mailing (internal) and/or external accounts

• Online journal

• Whiteboard

• Dropbox

• Document sharing, including digital pictures, audio, and streaming video

• Team areas that include tools for collaboration, managed by instructor

• Quiz, test, and survey options

• User-activity reports

Moodle Statistics

Moodle performs regular bulk checking of sites to make sure they still exist, so occasionally you may see reductions in the count

| Registered sites | 65,969 |

| Countries | 217 |

| Courses | 6,067,286 |

| Users | 57,967,060 |

| Teachers | 1,280,353 |

| Enrolments | 28,990,587 |

| Forum posts | 99,242,884 |

| Resources | 53,979,755 |

| Quiz questions | 108,468,848 |

According to www.trimeritus.com, the largest LMS providers are (in alphabetical order):

- Blackboard (BBBB) Learn (slated to go private in 3Q11)

- Certpoint Systems

- CornerstoneOnDemand (CSOD)

- Geometrix Training Partner

- Inmedius’ Generation21 Enterprise

- Knowledge Management Solutions’ KMx Enterprise

- Meridian’s KSI Knowledge Center

- Mzinga OmniSocial Learning Suite

- Outstart’s TrainingEdge.com

- Saba’s (SABA) Enterprise Learning Suite

- Success Factors’ (SFSF) Plateau Learning Management System/Talent Management Suite

- SumTotal Systems’s Total LMS and GeoLearning GeoMaestro

- Taleo’s (TLEO) Learn.com LearnCenter Workforce Productivity Suite

- TEDS Talent Management Solutions Suite

- WBT Systems’ TopClass LMS

Campus Buzz

We welcome Tips & Pitches

Latest WA Original Features

-

“Instreamia” Shakes Loose Moss By Launching Spanish Language Mini-MOOC

-

Jörn Loviscach: A German Math Teaching Sensation Emerges On YouTube & Udacity

-

Open University Enters Battle Of The MOOCs, Launches “FutureLearn”

-

Alvaro Salas As A Case Study In Crowd-Funding An Ivy-League Education

-

Jonathan Mugan: How To Build A Free Computer Within A Computer For Your Child

Paul Glader, Managing Editor

@paulglader

Eleni Glader, Policy Editor

Elbert Chu, Innovation Editor

@elbertchu

Biagio Arobba, Web Developer

@barobba

Contributors:

Michael B. Horn

@michaelbhorn

Derek Reed

@derekreed

Annie Murphy Paul

@AnnieMurphyPaul

Frank Catalano

@FrankCatalano

Ryan Craig

@UniVenturesFund

Jonathan Mugan

@JMugan

Terry Heick

@TeachThought

Alison Anderson

@tedrosececi

Ravi Kumar

@ravinepal

The Pulitzer Prize winning investigation newsroom digs into for-profit education.

-

Most Viewed

- Inside Ashford University: A former staffer talks to WiredAcademic

- Infographic: A History Of Information Organization From Stone-Age To Google

- Davos: 12-Year-Old Pakistani Prodigy Girl Talks About Her Online Learning

- Open University Enters Battle Of The MOOCs, Launches "FutureLearn"

- Guest Column: Why Steve Jobs would have loved digital learning

-

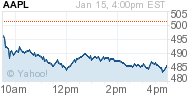

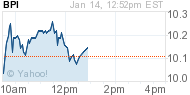

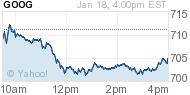

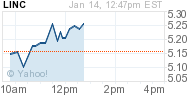

MARKET INTRADAY SNAPSHOT

- Education & Tech Companies We Follow

| APEI | 41.33 |  -0.16 -0.16 |  -0.39% -0.39% | ||

| APOL | 19.13 |  -0.18 -0.18 |  -0.93% -0.93% | ||

| AAPL | 448.85 |  -11.14 -11.14 |  -2.42% -2.42% | ||

| BPI | 10.83 |  -0.23 -0.23 |  -2.08% -2.08% | ||

| CAST | 0.11 |  0.00 0.00 |  +0.00% +0.00% | ||

| CECO | 4.07 |  -0.11 -0.11 |  -2.63% -2.63% | ||

| COCO | 2.31 |  -0.085 -0.085 |  -3.55% -3.55% | ||

| CPLA | 32.60 |  -0.30 -0.30 |  -0.91% -0.91% | ||

| DV | 31.74 |  -0.32 -0.32 |  -1.00% -1.00% | ||

| EDMC | 3.86 |  -0.09 -0.09 |  -2.28% -2.28% | ||

| ESI | 18.78 |  -0.32 -0.32 |  -1.68% -1.68% | ||

| GOOG | 792.46 |  -14.39 -14.39 |  -1.78% -1.78% | ||

| LINC | 6.23 |  -0.20 -0.20 |  -3.11% -3.11% | ||

| LOPE | 26.38 |  +0.82 +0.82 |  +3.21% +3.21% | ||

| PEDH | 0.45 |  0.00 0.00 |  +0.00% +0.00% | ||

| PSO | 18.41 |  -0.26 -0.26 |  -1.39% -1.39% | ||

| SABA | 8.49 |  -0.34 -0.34 |  -3.85% -3.85% | ||

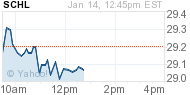

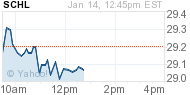

| SCHL | 31.09 |  +0.04 +0.04 |  +0.13% +0.13% | ||

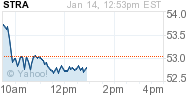

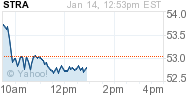

| STRA | 52.00 |  -0.27 -0.27 |  -0.52% -0.52% | ||

| WPO | 416.84 |  -2.01 -2.01 |  -0.48% -0.48% |

Domestic, For-Profit, Gainful Employment, Infographics, Personalized Learning, Private, Public, Required, Universities & Colleges - Jan 31, 2013 6:09 - 0 Comments

Infographic: To Get A Degree Or Not To Get A Degree? Here Is An Answer

More In For-Profit

- Ryan Craig: American Clampdown Forcing Forlorn For-Profit Colleges To Look Abroad

- How For-Profit Colleges Major In Marketing & Fail Education

- Infographic: A Graphical Profile Of Today’s Online College Student

- Infographic: A Comparison Of For-Profits v. Non-Profit Online College Data

- Opinion: How “Shareholder Value” Is Destroying For-Profit, Career Colleges

Cost of Education Domestic Education Quality Ethics For-Profit Friend, Fraud, or Fishy Gainful Employment Graduation Rates Legislation Minorities Opinion Recruitment Regulatory Required Retention Rates Student Loans Universities & Colleges

Blended Learning, International, MOOCs, OER - Open Educational Resources, Open Source Education, Personalized Learning, Required, Technology, Universities & Colleges - Feb 19, 2013 19:50 - 1 Comment

OU’s FutureLearn Inks Six New MOOC Institutions & Aims To Export Courses To India

More In Technology

- MOOC Monitor: Must Reads This Week

- Infographic: Rise of the MOOCs

- Smart Cities Part II: Why DC Is The Planetary Hub Of Online Learning

- Five Questions: Polling EdTech Startup UnderstoodIt’s Liam Kaufman

- Infographic: The Future of Higher Education

Cost of Education, Domestic, Early Childhood Education, Education Quality, Friend, Fraud, or Fishy, Legislation, Minorities, Parents, Public, Required - Feb 18, 2013 4:59 - 0 Comments

Important Early Questions Over Obama’s Early Childhood Program Ambitions

More In Friend, Fraud, or Fishy

- Should For-Profit Companies Manage K-12 Schools? A Skeptical Review

- A Letter To Sen. Tom Harkin About For-Profit Charter Schools

- Ryan Craig: American Clampdown Forcing Forlorn For-Profit Colleges To Look Abroad

- Opinion: The Problem With Deceptive Degree Aggregators In The Search For Online Courses & Degrees

- How For-Profit Colleges Major In Marketing & Fail Education

Domestic Education Quality Ethics For-Profit Friend, Fraud, or Fishy Graduation Rates Minorities Recruitment Required Retention Rates Universities & Colleges

Leave a Reply