Domestic, Mergers & Acquisitions, Publishers & Curriculum, Required, Universities & Colleges - Written by Wired Academic on Tuesday, November 27, 2012 1:00 - 0 Comments

Roundup: McGraw-Hill Sells Education Division To Apollo

Christopher Chan via Compfight

Christopher Chan via Compfight

McGraw-Hill agreed to sell its education division to Apollo Global Management for roughly $2.5 billion, marking the end of an era for McGraw-Hill as it exits the education business and remains largely a provider of financial information.

“After carefully considering all of the options for creating shareholder value, the McGraw-Hill board of directors concluded that this agreement generates the best value and certainty for our shareholders and will most favorably position the world-class assets of McGraw-Hill Education for long-term success,” Harold McGraw III, the company’s chairman and chief executive, said in a statement.

Larry Berg, a senior partner at Apollo, added: “With a longstanding track record of investing behind leaders in education, Apollo is pleased to be acquiring a marquee business that has been a pioneer in educational innovation and excellence for over a century.”

Here’s how three major media played the story…

Michael J. De La Merced writes in The New York Times:

The latest sale will speed up a breakup that was first announced in autumn last year, when McGraw-Hill disclosed plans to spin off its education unit. The publisher was one of many companies to pursue corporate dismemberment plans that were aimed at separating slower-growing businesses from faster-growing ones that would fetch higher values in the stock markets.

The education unit had long been one of McGraw-Hill’s best-known operations, begun with the purchase of an academic publisher in 1952. But its importance to the company has been eclipsed by the faster growth of businesses like Standard & Poor’s, which have benefited from the rise of the financial services sector…

The deal is expected to close as soon as the end of the year. The company will take a noncash charge of about $450 million to $550 million tied to the transaction.

Financing for the deal will come from Credit Suisse, Morgan Stanley, Jefferies, UBS, Nomura and the BMO Financial Group. McGraw-Hill was advised by Evercore Partners, Goldman Sachs and the law firms Wachtell, Lipton, Rosen & Katz and Clifford Chance. Apollo was advised by Credit Suisse, UBS and BMO, as well as the law firms Paul, Weiss, Rifkind Wharton & Garrison and Morgan, Lewis & Bockius.

Matt Robinson at Bloomberg News writes:

The education business’s sales have shrunk in seven of the past eight quarters as states and cities cut school budgets for textbooks. Apollo, co-founded more than 20 years ago by Leon Black, is buying the division as the industry reinvents how it publishes content.

The unit is “migrating to a more subscription-based business model, which would have more predictable revenues, and could conceivably have better profitability because you could eliminate the manufacturing and inventory costs,” said Peter Appert, an analyst with Piper Jaffray & Co. in San Francisco. “It’s all about figuring out ways to distribute your content and broaden its appeal in the market.” He spoke in an interview before a deal was announced.

The education division reported $2.3 billion in sales last year and publishes in more than 65 languages. McGraw-Hill has weighed a sale or a spinoff of the business since at least last year, when hedge-fund investor Jana Partners LLC proposed a plan for a breakup. McGraw-Hill “has consistently underperformed its potential and traded at a sizable discount,” with the education unit creating a “drag” on the company’s value, Jana said in August 2011…

McGraw-Hill’s origins date back to 1888, when McGraw’s great-grandfather, James H. McGraw, acquired The American Journal of Railway Appliances, according to the company’s website. More than 20 years later, he merged his book-publishing department with John Hill’s, creating the McGraw-Hill Book Co. In 2009, McGraw-Hill agreed to sell BusinessWeek magazine to Bloomberg LP, the parent of Bloomberg News.

Via Bloomberg News

Jeff Trachtenberg at The Wall Street Journal reports:

The sale ends a plan by McGraw-Hill to take the education unit public. McGraw-Hill said in September of last year that it intended to hive off its education arm from its financial-services business, which includes the Standard & Poor’s bond-rating service.

After reviewing offers—including one from private-equity firm Apax Partners Ltd., the majority owner of Cengage Learning, which publishes textbooks primarily for the college market—McGraw-Hill entered into exclusive talks with Apollo this month. Apollo was the highest bidder.

The price was lower than McGraw-Hill had hoped to get for its education business, reflecting the continued difficulties of the sector in general. On the precollege front, states have cut back significantly on textbook spending because of the difficult economy. The higher-education business is in a digital transition that has attracted new companies…

McGraw-Hill Education generated $836 million in revenue for the third quarter, down 11% from a year earlier. Its operating profit declined 20% to $253 million. McGraw-Hill Education said revenue at each component of its higher-education, professional and international group had declined during the quarter.

Campus Buzz

We welcome Tips & Pitches

Latest WA Original Features

-

“Instreamia” Shakes Loose Moss By Launching Spanish Language Mini-MOOC

-

Jörn Loviscach: A German Math Teaching Sensation Emerges On YouTube & Udacity

-

Open University Enters Battle Of The MOOCs, Launches “FutureLearn”

-

Alvaro Salas As A Case Study In Crowd-Funding An Ivy-League Education

-

Jonathan Mugan: How To Build A Free Computer Within A Computer For Your Child

Paul Glader, Managing Editor

@paulglader

Eleni Glader, Policy Editor

Elbert Chu, Innovation Editor

@elbertchu

Biagio Arobba, Web Developer

@barobba

Contributors:

Michael B. Horn

@michaelbhorn

Derek Reed

@derekreed

Annie Murphy Paul

@AnnieMurphyPaul

Frank Catalano

@FrankCatalano

Ryan Craig

@UniVenturesFund

Jonathan Mugan

@JMugan

Terry Heick

@TeachThought

Alison Anderson

@tedrosececi

Ravi Kumar

@ravinepal

The Pulitzer Prize winning investigation newsroom digs into for-profit education.

-

Most Viewed

- Inside Ashford University: A former staffer talks to WiredAcademic

- Infographic: A History Of Information Organization From Stone-Age To Google

- Davos: 12-Year-Old Pakistani Prodigy Girl Talks About Her Online Learning

- Open University Enters Battle Of The MOOCs, Launches "FutureLearn"

- Pearson Llc + Google Expands LMS Business With "OpenClass" System

-

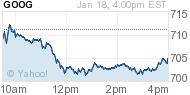

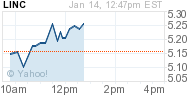

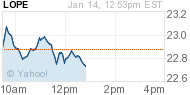

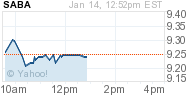

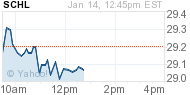

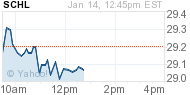

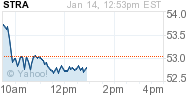

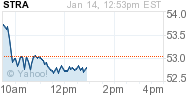

MARKET INTRADAY SNAPSHOT

- Education & Tech Companies We Follow

| APEI | 40.20 |  -0.17 -0.17 |  -0.42% -0.42% | ||

| APOL | 19.01 |  +0.33 +0.33 |  +1.77% +1.77% | ||

| AAPL | 460.16 |  -6.43 -6.43 |  -1.38% -1.38% | ||

| BPI | 10.74 |  -0.09 -0.09 |  -0.83% -0.83% | ||

| CAST | 0.11 |  +0.01 +0.01 |  +10.00% +10.00% | ||

| CECO | 4.08 |  -0.02 -0.02 |  -0.49% -0.49% | ||

| COCO | 2.40 |  -0.02 -0.02 |  -0.83% -0.83% | ||

| CPLA | 32.03 |  -0.41 -0.41 |  -1.26% -1.26% | ||

| DV | 30.69 |  +0.36 +0.36 |  +1.19% +1.19% | ||

| EDMC | 4.03 |  +0.07 +0.07 |  +1.77% +1.77% | ||

| ESI | 18.34 |  +0.04 +0.04 |  +0.22% +0.22% | ||

| GOOG | 792.89 |  +5.07 +5.07 |  +0.64% +0.64% | ||

| LINC | 6.20 |  +0.06 +0.06 |  +0.98% +0.98% | ||

| LOPE | 25.03 |  +0.36 +0.36 |  +1.46% +1.46% | ||

| PEDH | 0.45 |  0.00 0.00 |  +0.00% +0.00% | ||

| PSO | 18.51 |  -0.27 -0.27 |  -1.44% -1.44% | ||

| SABA | 8.61 |  -0.16 -0.16 |  -1.82% -1.82% | ||

| SCHL | 30.87 |  +0.46 +0.46 |  +1.51% +1.51% | ||

| STRA | 51.95 |  -1.54 -1.54 |  -2.88% -2.88% | ||

| WPO | 414.41 |  +5.35 +5.35 |  +1.31% +1.31% |

Domestic, For-Profit, Gainful Employment, Infographics, Personalized Learning, Private, Public, Required, Universities & Colleges - Jan 31, 2013 6:09 - 0 Comments

Infographic: To Get A Degree Or Not To Get A Degree? Here Is An Answer

More In For-Profit

- Ryan Craig: American Clampdown Forcing Forlorn For-Profit Colleges To Look Abroad

- How For-Profit Colleges Major In Marketing & Fail Education

- Infographic: A Graphical Profile Of Today’s Online College Student

- Infographic: A Comparison Of For-Profits v. Non-Profit Online College Data

- Opinion: How “Shareholder Value” Is Destroying For-Profit, Career Colleges

Cost of Education Domestic Education Quality Ethics For-Profit Friend, Fraud, or Fishy Gainful Employment Graduation Rates Legislation Minorities Opinion Recruitment Regulatory Required Retention Rates Student Loans Universities & Colleges

MOOCs, Required, Technology - Feb 16, 2013 10:04 - 0 Comments

MOOC Monitor: Must Reads This Week

More In Technology

- Infographic: Rise of the MOOCs

- Smart Cities Part II: Why DC Is The Planetary Hub Of Online Learning

- Five Questions: Polling EdTech Startup UnderstoodIt’s Liam Kaufman

- Infographic: The Future of Higher Education

- Anne Collier: Study Shows eBooks Gaining Larger Share & Boosting Overall Reading Habits

Domestic K-12 Parents Reading / Literature Required Technology

Charter, Cost of Education, Domestic, Education Quality, Friend, Fraud, or Fishy, K-12, Minorities, Regulatory, Required - Feb 7, 2013 12:23 - 0 Comments

Should For-Profit Companies Manage K-12 Schools? A Skeptical Review

More In Friend, Fraud, or Fishy

- A Letter To Sen. Tom Harkin About For-Profit Charter Schools

- Ryan Craig: American Clampdown Forcing Forlorn For-Profit Colleges To Look Abroad

- Opinion: The Problem With Deceptive Degree Aggregators In The Search For Online Courses & Degrees

- How For-Profit Colleges Major In Marketing & Fail Education

- Infographic: A Comparison Of For-Profits v. Non-Profit Online College Data

Cost of Education Domestic For-Profit Friend, Fraud, or Fishy Graduation Rates Infographics Recruitment Required Universities & Colleges

Leave a Reply